Essay

Leidos and the Roberts Court’s Improvident Securities Law Docket

Matthew C. Turk & Karen E. Woody *

For its October 2017 term, the U.S. Supreme Court took up a noteworthy securities law case, Leidos, Inc. v. Indiana Public Retirement System. 1 See Ind. Pub. Ret. Sys. v. SAIC, Inc., 818 F.3d 85 (2d Cir. 2016), cert. granted sub nom. Leidos, Inc. v. Ind. Pub. Ret. Sys., 137 S. Ct. 1395 (2017). The legal question presented in Leidos was whether a failure to comply with a regulation issued by the Securities and Exchange Commission (SEC), Item 303 of Regulation S-K (Item 303), can be grounds for a securities fraud claim pursuant to Rule 10b-5 and the related Section 10(b) of the 1934 Securities Exchange Act. Leidos teed up a significant set of issues because Item 303 concerns one of the more controversial corporate disclosures mandated by the SEC—an overview of known uncertainties facing a company’s financial future, which must be provided in the company’s “Management’s Discussion and Analysis” (MD&A). In an unusual twist to an already unusual case, the parties in Leidos announced a tentative settlement weeks before the Supreme Court was set to hear oral argument, and have successfully moved to hold the case in abeyance on the Court’s docket until the proposed settlement is ultimately rejected or approved. 2 Order in Pending Case, No. 16-581, 2017 WL 4622142 (Oct. 17, 2017). If the settlement is not approved by the Southern District of New York, Leidos will be back on the Supreme Court’s docket for the October 2018 term.

Leidos was billed in both the briefing to the Supreme Court and academic commentary as a classic circuit split between the Ninth and Second Circuits. As detailed below, however, a careful reading of the precedents reveals that there is no genuine dispute among the federal courts. All of the relevant circuit court opinions agree that a violation of Item 303 may constitute a viable fraud claim under of Rule 10b-5 in some, but not all, circumstances. They also follow the same underlying reasoning for how those circumstances are to be determined, which turns on the applicable materiality standard for securities fraud. Leidos therefore left so little to be resolved that it was ripe for removal from the Supreme Court’s docket, even before news of a settlement was released, on the grounds that certiorari has been improvidently granted.

The confusion surrounding Leidos is of broader importance for understanding the evolution of the Supreme Court’s securities law jurisprudence since John Roberts became Chief Justice in 2005. A consensus across the growing body of scholarship on that topic is that one of the salient features of the Roberts Court thus far is an uptick in the number of securities law cases taken up for review. 3 Relevant entries in the growing literature on the Roberts Court’s securities law docket include Eric C. Chaffee, The Supreme Court as Museum Curator: Securities Regulation and the Roberts Court, 67 Case Western Res. L. Rev. 847, 848-49 (2017); John C. Coates IV, Securities Litigation in the Roberts Court: An Early Assessment, 57 Ariz. L. Rev. 1, 3 (2015); Eric Alan Isaacson, The Roberts Court and Securities Class Actions: Reaffirming Basic Principles, 48 Akron L. Rev. 923, 924-26 (2015); A.C. Pritchard, Securities Law in the Roberts Court: Agenda or Indifference?, 37 J. Corp. L. 105, 106 (2011). Leidos highlights what is quickly becoming another defining characteristic: that the Roberts Court’s enthusiasm for granting certiorari on securities law petitions has been accompanied by a tendency to misapprehend the issues (or lack thereof) which those cases raise. This practice reflects an inefficient use of the Court’s scarce docket space. It also represents a missed opportunity to clarify the many areas of securities regulation that remain mired in doctrinal incoherence.

I. Regulatory & Case Background

A. Materiality Under Item 303 Versus Rule 10b-5

The Leidos case focused on the relationship between two SEC regulations: Item 303 of Regulation S-K and Rule 10b-5. Rule 10b-5 implements the prohibition against securities fraud found in Section 10(b) of the 1934 Securities Exchange Act. The rule provides that it is unlawful for any person to “make any untrue statement of a material fact or to omit to state a material fact necessary in order to make the statements made, in the light of the circumstances under which they were made, not misleading” in connection with the sale of a security. 4 17 C.F.R. § 240.10b-5(b) (2016). Since being promulgated by the SEC in 1942, the anti-fraud standard laid out in Rule 10b-5 has been the core enforcement mechanism in securities regulation.

Rule 10b-5’s requirement that omitted or untrue information must relate to a “material fact” in order to be actionable was not precisely defined until 1976, when the Supreme Court held in TSC Industries, Inc. v. Northway, Inc. that a fact will be considered material if it “would have been viewed by the reasonable investor as having significantly altered the ‘total mix’ of information made available.” 5 426 U.S. 438, 449 (1976). In the 1988 case Basic Inc. v. Levinson, the Court further refined this standard by articulating that a “probability-versus-magnitude test” must be applied when determining whether speculative or forward-looking information is material. 6 485 U.S. 224, 238 (1988). Specifically, it held that “materiality ‘will depend at any given time upon a balancing of both the indicated probability that the event will occur and the anticipated magnitude of the event in light of the totality of the company activity.’” 7 Id. (quoting SEC v. Tex. Gulf Sulphur Co., 401 F.2d 833, 849 (2d Cir. 1968) (en banc)).

Regulation S-K was adopted by the SEC in 1980 in order to synthesize the overlapping disclosure requirements that were provided under the 1933 Securities Act (which covers initial offerings) and the 1934 Exchange Act (which calls for annual and quarterly disclosures on a periodic basis). 8 John C. Coffee, Jr., Re-Engineering Corporate Disclosure: The Coming Debate over Company Registration, 52 Wash. & Lee L. Rev. 1143, 1145 (1995) (describing the widespread criticism of the “pointless duplication” in disclosure rules prior to Reg S-K). Item 303 of Regulation S-K requires disclosure of management’s subjective take on the state of the firm. 9 17 C.F.R. § 229.303(a)(3)(ii) (2016). In particular, Item 303 requires the identification and description of any “known trends or uncertainties” that management reasonably suspects will have a material effect on the company’s financial prospects. 10 Id. Because it not only aims to provide a window into management’s own thinking, but also appears to seek their prognostications about future events, Item 303 has been considered one of the more important and controversial disclosure rules that has been released by the SEC as part of Regulation S-K. 11 See Suzanne J. Romajas, The Duty to Disclose Forward-Looking Information: A Look at the Future of MD&A, 61 Fordham L. Rev. (Special Issue) S245, S247 & n.15 (1993) (“Noncompliance with Item 303 denies investors access to the information that is most valuable to their investment decision. . . . Since investment decisions are inherently forward-looking, the importance of such information cannot be understated.”); Eric R. Harper, Comment, Unveiling Management’s Crystal Ball, 77 La. L. Rev. 879, 879-80 (2017); Brian Neach, Note, Item 303’s Role in Private Causes of Action Under the Federal Securities Laws, 76 Notre Dame L. Rev. 741, 744 (2001) (calling the availability of MD&A-based allegations in Section 10(b) claims a potential “bullet in the [securities plaintiff] attorney’s revolver”).

One year after Basic, in a 1989 interpretive release, the SEC explained its standard for materiality when considering the forward-looking information required by Item 303 by providing the following test:

(1) Is the known trend, demand, commitment, event or uncertainty likely to come to fruition? If management determines that it is not reasonably likely to occur, no disclosure is required. (2) If management cannot make that determination, it must evaluate objectively the consequences of the known trend, demand, commitment, event or uncertainty, on the assumption that it will come to fruition. Disclosure is then required unless management determines that a material effect on the registrant’s financial condition or results of operations is not reasonably likely to occur. 12 Management’s Discussion and Analysis of Financial Condition and Results of Operations, 54 Fed. Reg. 22427, 22430 (May 18, 1989).

The plain language of the Item 303 materiality standard departs noticeably from the probability-versus-magnitude formula set forth in Basic. In fact, the 1989 SEC Release includes an explicit disclaimer that the Basic definition of materiality should be considered “inapposite” to Item 303. 13 Id. at 22430 n.27. SEC officials have also opined that the Item 303 standard is slightly lower than that which applies to fraud claims under Rule 10b-5, 14 Edward H. Fleischman, Comm’r, SEC, The Intersection of Business Needs and Disclosure Requirements: MD&A, Address to the Eleventh Annual Southern Securities Institute (Mar. 1, 1991). and most academic analyses agree. 15 See John C. Coffee, Jr., The Future of the Private Securities Litigation Reform Act: Or, Why the Fat Lady Has Not Yet Sung, 51 Bus. Law. 975, 993-94 (1996); Mark S. Croft, MD&A: The Tightrope of Disclosure, 45 S.C. L. Rev. 477, 483 (1994); Harper, supra note 11, at 897; Donald C. Langevoort, Toward More Effective Risk Disclosure for Technology-Enhanced Investing, 75 Wash. U. L.Q. 753, 775 (1997) (“[T]he Commission’s MD&A requirement expressly rejects materiality as the threshold for disclosure of known trends or uncertainties. What comes in its place is a higher standard, though not much more determinate: disclosure is required only of trends and uncertainties that are ‘reasonably likely to occur’ . . . .”); Neach, supra note 11, at 751-56.

A consequence of the slightly lower materiality threshold for Item 303 is that it reduces the range of claims that private investors may bring based on firms’ incomplete disclosure of required MD&A information. That is because violations of Item 303 do not create any stand-alone private right of action. 16 See Oran v. Stafford, 226 F.3d 275, 287 (3d Cir. 2000) (making this point and citing a string of cases that have come to the same conclusion). The SEC can bring actions under either Item 303, Rule 10b-5, or both; yet investors are limited to the latter. 17 See Harper, supra note 11, at 894-900. For offering documents subject to Sections 11 and 12, the SEC reviews disclosures before they become effective. Coffee, supra note 15, at 1155-58. Likewise, for periodic disclosures subject to 10(b), such as 10-Ks, the SEC also can take administrative actions by issuing cease-and-desist orders that seek injunctive relief. Harper, supra note 11, at 894-96. This creates a gap, however theoretical, in which a hypothetical omitted disclosure could be material for purposes of Item 303 but not Rule 10b-5. 18 Douglas W. Greene, Why Item 303 Just Doesn’t Matter in Securities Litigation, Law360 (Oct. 13, 2015, 12:49 PM EDT), https://perma.cc/58WN-MAFJ (arguing that this distinction is of minimal practical significance for actual securities cases).

B. Leidos in the Lower Courts

Leidos began as a federal securities class action filed in the Southern District of New York on February 22, 2012. 19 In re SAIC, Inc. Sec. Litig., No. 12 Civ. 1353(DAB), 2013 WL 5462289 (S.D.N.Y. Sept. 30, 2013). The class plaintiff’s allegations arose from a contract entered into by SAIC (now doing business as Leidos, Inc.) and the City of New York (NYC) in 2001. 20 Id. at *1-2. Pursuant to that contract, Leidos committed to develop an automated workplace management system, CityTime, which was to be used by NYC’s administrative agencies. 21 Id. The initial budget for CityTime was $63 million, but SAIC ended up billing NYC $628 million for its work on CityTime. 22 Id. It eventually became clear, both internally at SAIC and to the NYC Bloomberg administration, that the inflated bill was due to an elaborate fraud by certain Leidos employees. 23 Id. Criminal charges were filed against CityTime personnel, NYC severed its business relationship with Leidos, and the entire project was ultimately a total loss. 24 Id.

Plaintiffs alleged that a SAIC 10-K of March 2011 omitted information required under Item 303’s MD&A rules, and therefore constituted securities fraud under Rule 10b-5. 25 Id. at *11. Specifically, the class asserted that SAIC knew of the extensive fraud that took place in connection with its CityTime project, and further knew that the fraud would have a material impact on the company. 26 Id. at *10-11. Thus, plaintiffs contended that the potential fallout from the fraud should have been disclosed as a “known trend or uncertainty” pursuant to Item 303. 27 Id. at *11.

In the district court, plaintiffs’ claims were dismissed with prejudice for failure to adequately plead the materiality element required under Section 10(b). 28 Id.; see also In re SAIC, Inc. Sec. Litig., No. 12 Civ. 1353(DAB), 2014 WL 407050, at *1, 4 (S.D.N.Y. Jan. 30, 2014). But the Second Circuit reversed in part and remanded the matter to the district court, explaining that “failure to comply with Item 303 . . . can give rise to liability under Rule 10b-5 so long as the omission is material under Basic . . . and the other elements of Rule 10b-5 have been established.” 29 See Ind. Pub. Ret. Sys. v. SAIC, Inc., 818 F.3d 85, 94 n.7, 98 (2d Cir. 2016) (quoting Stratte-McClure v. Morgan Stanley, 776 F.3d 94, 103-04 (2d Cir. 2015)). In doing so, the Second Circuit opinion specifically referenced the SEC’s 1989 release on materiality under Item 303. 30 Id. at 94. Thus, the court of appeals made clear that “Item 303 imposes an ‘affirmative duty to disclose. . . . [that] can serve as the basis for a securities fraud claim under Section 10(b).’” 31 Id. n.7 (alteration in original) (emphasis added) (quoting Stratte-McClure, 776 F.3d at 101).

II. The Phantom Circuit Split

As framed in Leidos’ briefing to the Supreme Court, the case reflected “a deep split of authority with respect to one of the most important—and frequently invoked—provisions of the federal securities laws.” 32 Petition for Writ of Certiorari at 1, Leidos, Inc. v. Ind. Pub. Ret. Sys., No. 16-581 (U.S. Oct. 31, 2016), 2016 WL 6472615. According to the petition for writ of certiorari, 33 Id. at 7. that split first materialized in a decision from 2015, Stratte-McClure v. Morgan Stanley, in which Judge Livingston’s opinion for the Second Circuit declared that its interpretation of the relationship between Item 303 and Rule 10b-5 was “at odds” 34 Stratte-McClure, 776 F.3d at 103. with a Ninth Circuit case from the prior year, In re NVIDIA Corp. Securities Regulation. 35 768 F.3d 1046 (9th Cir. 2014). Because the Second Circuit in Leidos closely followed the reasoning set forth in Stratte-McClure, Leidos supposedly escalated this preexisting conflict among the federal appellate courts. In taking up Leidos, the Supreme Court presumably found the certiorari petition’s narrative compelling. That same narrative also reappeared substantively unchanged in the amicus briefing to the Court, 36 See, e.g., Brief for the Securities Industry & Financial Markets Ass’n & Chamber of Commerce of the United States of America as Amici Curiae Supporting Petitioner at 3, Leidos, No. 16-581, 2016 WL 7011426. client updates released by major corporate law firms, 37 See, e.g., Sullivan & Cromwell LLP, Securities Litigation: U.S. Supreme Court Grants Certiorari to Decide Issue that Might Have Significant Impact on Registrants’ Exposure for Non-Disclosure of “Known Trends or Uncertainties” in SEC Filings 2-3 (2017), https://perma.cc/GQ8E-22RQ. academic legal blogs, 38 See, e.g., Audra Soloway et al., Paul Weiss Discusses Securities Fraud Liability Based Solely on Omissions, CLS Blue Sky Blog (Apr. 6, 2017), https://perma.cc/GAM6-KBLX. a leading securities casebook, 39 See, e.g., James D. Cox et al., Securities Regulation: Cases & Materials 611 (8th ed. 2017). as well as a number of scholarly articles. 40 See, e.g., Harper, supra note 11, at 900-08 (2017); Lauren M. Mastronardi, Note, Shining the Light a Little Brighter: Should Item 303 Serve as a Basis for Liability Under Rule 10b-5?, 85 Fordham L. Rev. 335, 350-51, 354-59 (2016).

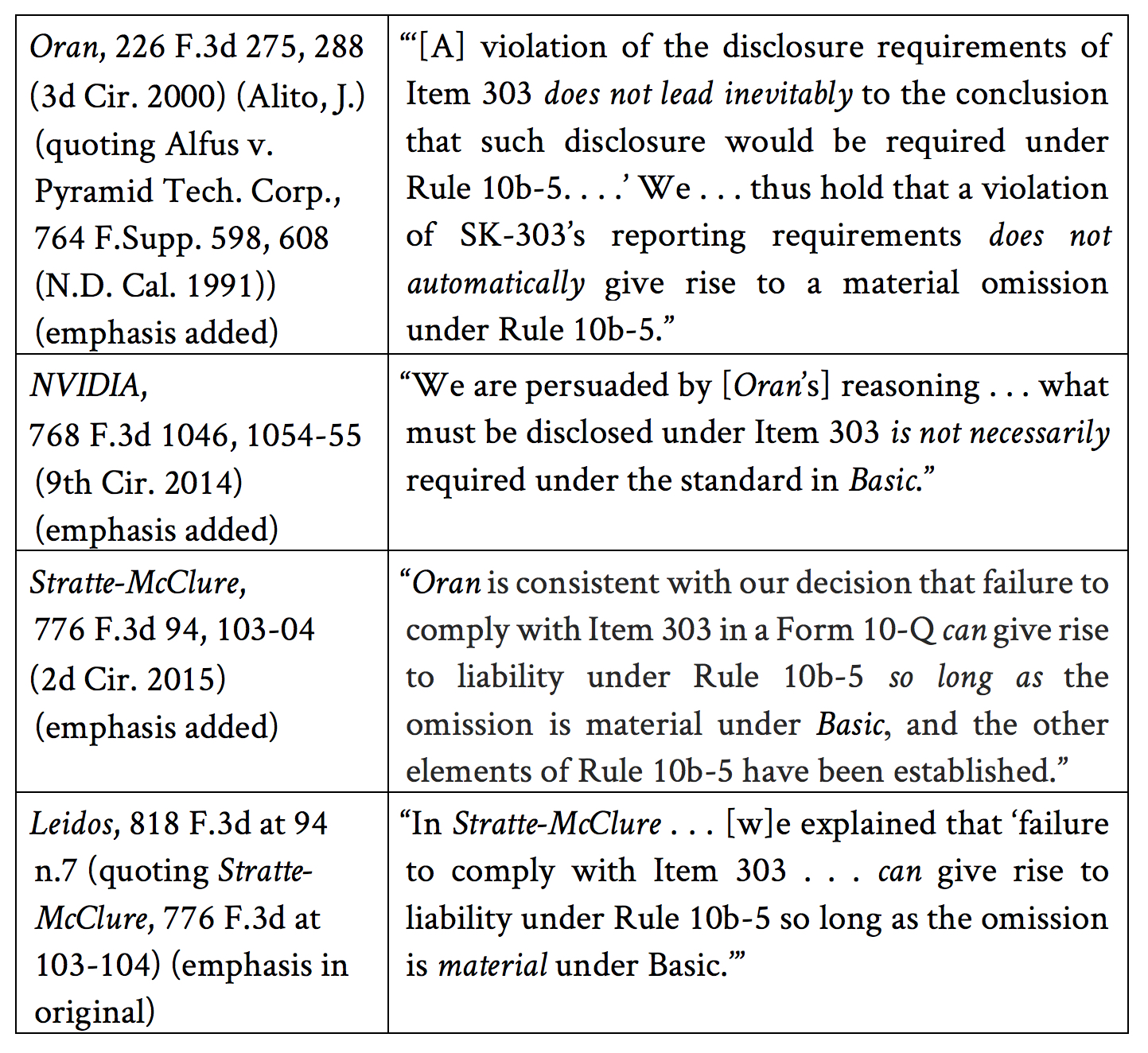

There is something deeply odd about this consensus, though, because on the core legal question at issue in Leidos, the Second Circuit and Ninth Circuit are in full agreement. 41 Although a number of contributing factors may explain this confusion, the most likely proximate cause is an uncritical acceptance of Judge Livingston’s “at odds” statement, which ultimately rests on a misreading of the Ninth Circuit’s NVIDIA case. Compare Stratte-McClure v. Morgan Stanley, 776 F.3d 94, 103-04 (2d Cir. 2015) (“Contrary to the Ninth Circuit’s implication [in NVIDIA] that . . . Item 303 violations are never actionable under 10b-5 . . . . our decision [holds] that failure to comply with Item 303 in a Form 10-Q can give rise to liability under Rule 10b-5 so long as the omission is material under Basic . . .”), with In re NVIDIA Corp. Sec. Litig., 768 F.3d 1046, 1055 (9th Cir. 2014) (“Management’s duty to disclose under Item 303 is much broader than what is required under the standard pronounced in Basic. . . . Therefore, ‘[b]ecause the materiality standards for Rule 10b5 and [Item 303] differ significantly, the “demonstration of a violation of the disclosure requirements of Item 303 does not lead inevitably to the conclusion that such disclosure would be required under Rule 10b-5.”’” (quoting Oran v. Stafford, 226 F.3d 275, 288 (3d Cir. 2000))). The “implication” that the opinion in Stratte-McClure attributes to the Ninth Circuit (and then purports to dispute) cannot be found in a fair reading of the NVIDIA opinion. A second look at the underlying precedents makes this clear. The relevant cases from both circuits follow an earlier Third Circuit opinion written by then-Circuit Judge Alito, Oran v. Stafford, and come to the same conclusion: A failure to comply with Item 303 may constitute a violation of Rule 10b-5 under some circumstances, but does not always automatically do so. 42 226 F.3d at 288; see also Stratte-McClure, 776 F.3d at 103; NVIDIA, 768 F.3d at 1055. A simple timeline of the unambiguous language from the holdings reflects this consensus:

There are only two logical alternatives to the outcome announced in Leidos: either noncompliance with Item 303 constitutes a per se violation of Rule 10b-5, or Item 303 provides a safe harbor, meaning that any “known trend or uncertainty” disclosure (or omission) would be immune from fraud claims. As the language referenced above indicates, none of the relevant federal court decisions have adopted either position.

An unavoidable conclusion is that the circuit split which the Supreme Court was presumably on course to resolve does not in fact exist. Had the case remained on the Supreme Court docket, the Court likely would have summarily affirmed the Second Circuit decision in Leidos, and on the same grounds as were articulated in Judge Lohier’s opinion for the court in that case. The further upshot is that Leidos did not present any legal question worth addressing by the Supreme Court, and represents a case where, for all practical purposes, the writ of certiorari was improvidently granted.

III. The Supreme Court’s Improvident Securities Law Docket

Leidos was the latest securities case for the Supreme Court under Chief Justice Roberts which, depending on how you count, has now issued roughly twenty securities-related decisions. 43 See Chaffee, supra note 3, at 848. As a result, there is a sizeable body of commentary that seeks to characterize these opinions. The three main trends which have been observed are: (1) an increase in the proportion of the Supreme Court cases that deal with securities law issues; (2) increased agreement among the justices in those cases; and (3) conservative (as in low-impact, rather than “pro-business”) decisions. 44 See id. at 850-51; Coates, supra note 3, at 3-5; Isaacson, supra note 3, at 924-26; Pritchard, supra note 3, at 108-09. Leidos not only encapsulates these trends but also points to a bigger-picture takeaway: that the Roberts Court is compiling a growing line of securities cases which should have avoided review in the first place.

One only has to look as far back as the previous Court term to find another example of a securities law decision, Salman v. United States, 45 137 S. Ct. 420 (2016). that neither clarified nor altered the existing law. Salman, a case about a brother-in-law’s provision of stock tips, was anticipated to produce a blockbuster reformulation of insider trading law. 46 See, e.g., All Eyes on Salman: The Supreme Court’s Newest Blockbuster Insider Trading Case, Insider Trading & Disclosure Update, Aug. 2016, at 17, 17. Having recently denied a writ of certiorari in United States v. Newman, another insider trading case, the Court agreed to hear Salman, creating an appearance that a decision in Salman would clarify insider trading doctrine in a widely applicable manner. Id.; see also 136 S. Ct. 242 (2015). The defendants in Newman were “several steps removed” from the corporate insider tippers, and their convictions were vacated by the Second Circuit because there was no evidence that either defendant was aware of the source of the inside information or that the insiders received any benefit for the disclosures. United States v. Newman, 773 F.3d 438, 442-43 (2d Cir. 2014). But as it turned out, the Court issued an opinion that simply repeated a longstanding test and failed to clear the muddy waters of insider trading doctrine.

Specifically, Salman argued that he was not guilty of insider trading because his brother-in-law, the tipper, had not received any financial benefit for the tip. 47 Salman, 137 S. Ct. at 423-24. Under Dirks v. SEC, 48 463 U.S. 646 (1983). a tippee may be held liable for insider trading, provided the tipper has received a “direct or indirect personal benefit from the disclosure.” 49 Id. at 663. Yet Dirks also made clear that a personal benefit can be inferred when the insider makes a “gift of confidential information to a trading relative or friend.” 50 Id. at 664. The facts of Salman involved a brother-in-law providing information; thus, the tipper-tippee relationship fell squarely within the definition of “relative or friend.” 51 At the Circuit level, Salman attempted to use the Newman holding to argue that any exchange of information, even to a friend or family member, must include “at least a potential gain of a pecuniary or similarly valuable nature.” United States v. Salman, 792 F.3d 1087, 1093 (9th Cir. 2015) (quoting United States v. Newman, 773 F.3d 438, 452 (2d Cir. 2014)). However, the facts of Newman did not include any family or close friend relationship among the tippers and tippees. See Newman, 773 F.2d at 442. In addition, the Newman court recognized that personal benefit is “broadly defined” and can include the “benefit one would obtain from simply making a gift of confidential information to a trading relative or friend.” Id. at 452 (quoting United States v. Jiau, 734 F.3d 147, 153 (2d Cir. 2013)). Unsurprisingly, the Court held unanimously that Salman was guilty of insider trading under the Dirks test, 52 Salman, 137 S. Ct. at 424. which, it should be noted, is a test that no lower court had attempted to abrogate. In other words, Salman was merely a reiteration of Dirks, and provided no insight or clarification on the elements of insider trading. 53 See Jonathan R. Macey, The Genius of the Personal Benefit Test, 69 Stan. L. Rev. Online 64, 72 (2016) (“Salman[] breaks no new ground and presents no issues that are either novel or complex.”); see also id. at 67, 71 (questioning “why the Supreme Court agreed to hear the case at all” . . . in light of the fact that the “familial relationship in Salman and the absence of such a relationship in Newman not only makes these cases easily reconcilable, it—along with the absence of a consequential personal benefit in Salman—explains why both cases were correctly decided”).

Leidos and Salman are not the only securities cases where grants of certiorari by the Roberts Court turned out to be duds. Two other recent cases have been withdrawn prior to argument, because either the Court or the parties determined the issues were not worth litigating. 54 Pub. Emps. Ret. Sys. v. IndyMac MBS, Inc., 135 S. Ct. 42 (2014); UBS Fin. Servs. Inc. v. Union de Empleados de Muelles, 134 S. Ct. 40 (2013). In a 2014 case, Public Employees’ Retirement System v. IndyMac MBS, Inc., which asked whether filing a securities class action tolls the statute of limitations for all members of the class, the Court held—just one week prior to scheduled argument—that certiorari had been improvidently granted. 55 Pub. Emps. Ret. Sys., 135 S. Ct. at 42. And in 2013, the parties in UBS Financial Services, Inc. v. Union de Empleados de Muelles settled two months after certiorari was granted. 56 Union de Empleados, 134 S. Ct. at 40 (dismissing the petition for writ of certiorari on August 26, 2013); see also UBS Fin. Servs. Inc. v. Union de Empleados Muelles, 133 S. Ct. 2857 (granting certiorari on June 24, 2013).

Along with the aforementioned cases, which had effectively zero impact, other recent entries on the Roberts Court docket have resulted in perfunctory unanimous decisions which intervene at the margins of securities law doctrine. For instance, in 2011, the Court held in Matrixx Initiatives, Inc. v. Siracusano that the statistical significance of omitted information in corporate disclosures is not required for establishing materiality or scienter. 57 Matrixx Initiatives, Inc. v. Siracusano, 563 U.S. 27, 30-31 (2011); see, e.g., Decision in Matrixx Initiatives, Inc. v. Siracusano Rejects Bright-Line Rule in Securities Fraud Action Based on Pharmaceutical Company’s Failure to Disclose Adverse Event, DavisPolk: Client Newsflash (Mar. 22, 2011), https://perma.cc/H5U5-JLGA (“The Court’s opinion[] . . . does not change the status quo regarding the standard for evaluating materiality and does not provide more definitive guidance to companies concerned with when and what to disclose . . . .”); Ronald Mann, Opinion Analysis: Chalk One Up for the Ninth Circuit, SCOTUSblog (Mar. 24, 2011, 7:10 AM), https://perma.cc/XMB9-W48E (“In the end, . . . the opinion in this case is more likely to stand for its generous review of allegations in complaints than it is to make any important contribution to the substance of securities law.”). Likewise, in Jones v. Harris Associates, a 2010 opinion, the Court held that investment advisors violate their fiduciary duties if they charge disproportionately large fees. 58 Jones v. Harris Assocs. L.P, 559 U.S. 335, 346, 353 (2010); see, e.g., Supreme Court Decides Jones v. Harris Associates and Establishes Standard for Mutual Fund Excessive Fee Claims, Ropes & Gray LLP (Mar. 26, 2010), https://perma.cc/3CSL-TF84 (“[I]t is expected that the decision will not fundamentally change the process by which boards of mutual funds review and approve advisor fees. . . . The Court acknowledged in today’s opinion that the standard it adopted has been the ‘consensus’ for over 25 years.”). In a 2013 opinion, Gabelli v. SEC, the Court unanimously upheld the preexisting statute of limitations standard for securities fraud, but was required to overturn the Second Circuit’s opinion allowing the SEC to bring actions after the statute of limitations period tolled. 59 Gabelli v. SEC, 133 S. Ct. 1216, 1224 (2013). All of these cases yielded Supreme Court opinions of various lengths, but likely could have been resolved on the papers with a per curiam decision.

Of course, there is nothing wrong with reaffirming precedent, nor with agreement among the justices. But the specific form of agreement that has characterized recent securities law cases is disconcerting. Mainly, these decisions reflect that the significance of the petitions for certiorari was misapprehended at the outset. The result is that no real conflicts among the federal circuits are being resolved, and no open questions in the doctrine are being answered.

Given the ever-shrinking docket of the Supreme Court, the cases surveyed above represent a clear misallocation of judicial resources. Moreover, that misallocation is particularly significant because there are contested doctrinal issues in securities regulation that need to be revisited. Often, the questions that are avoided are right under the Court’s nose in cases it has taken up. For example, there is line of precedents relating to Salman that present legitimate puzzles as to what constitutes a “personal benefit,” a “gift,” or a “friend” under the Dirks test for insider trading, all of which call for the Court to provide guidance. 60 See Salman v. United States, 137 S. Ct. 420, 428-29 (2016) (noting that the question of what determines a personal benefit will be a difficult issue of fact for courts); United States v. Martoma, 869 F.3d 58, 61 (2d. Cir. 2017). In Martoma, the Second Circuit attempted to read the “close relationship” element out of the Dirks personal benefit test, stating that the “logic of Salman” indicates that “a corporate insider personally benefits whenever he ‘disclos[es] inside information as a gift . . . with the expectation that [the recipient] would trade’ on the basis of such information or otherwise exploit it for his pecuniary gain.” Id. at 61, 69 (alterations in original) (quoting Salman, 137 S. Ct. at 428). In her dissent, Judge Pooler points out that the Martoma holding mirrored the government argument in Salman: a gift of confidential information to anyone constitutes securities fraud. Id. at 86-87. However, Judge Pooler stressed that the Supreme Court did not adopt that view in Salman and therefore did not expressly overrule the “meaningful close relationship” requirement of Newman or Dirks. Id. at 87. Similarly, there is a genuine circuit split tangentially related to Leidos, over whether Item 303 omissions trigger a per se violation of Sections 11 or 12 of the 1933 Securities Act (as opposed to Section 10(b) of the 1934 Securities Exchange Act). 61 Matthew C. Turk & Karen E. Woody, The Leidos Mixup and the Misunderstood Duty to Disclose in Securities Law, 75 Wash. & Lee L. Rev. (forthcoming 2018).

In short, given this Essay’s interpretation of Leidos and related Supreme Court opinions from recent years, the Roberts Court’s track record on securities law cases could be summed up in revisionist terms as: welcome enthusiasm, workmanlike decision-making, limited foresight.

* Matthew C. Turk and Karen E. Woody are both Assistant Professors of Business Law at Indiana University’s Kelley School of Business. The authors would like to thank Brian Broughman, Donna Nagy, Christiana Ochoa and other participants at the Indiana University Maurer School of Law faculty workshop for their helpful comments.